Looking at the investment landscape in 2024, Commerce Trust believes the bond market is an area for investors to consider directing some attention, as the current interest rate environment presents opportunities not seen in over 15 years. Having experienced two periods of near-zero interest rates in the aftermaths of the 2007-08 global financial crisis and the COVID-19 pandemic, many investors have been quite satisfied to park cash in short-term instruments like Treasury bills, CDs, and money market funds that currently offer yields of 5% or more. In fact, since the Federal Reserve (Fed) embarked on its aggressive rate-hiking campaign in March 2022, $1.5 trillion has poured into money market funds, with total assets in those investments at approximately $6 trillion.1

While income-oriented investors have benefitted from higher interest rates, it is important to understand that rates on money market funds closely follow economic cycles. At this point in the cycle, the Fed appears to be finished with the rate-hiking phase of its efforts to tamp down inflation. Its next move will likely be to cut rates to guard against the possibility of the economy slowing too quickly under the weight of its hawkish monetary policy of the past two years. And it’s not only savers who would take note of the potential for a reversal in interest rates. Equity-centric investors who have ridden stock markets to new highs may benefit from taking note of the attractive forward returns still available in the bond market.

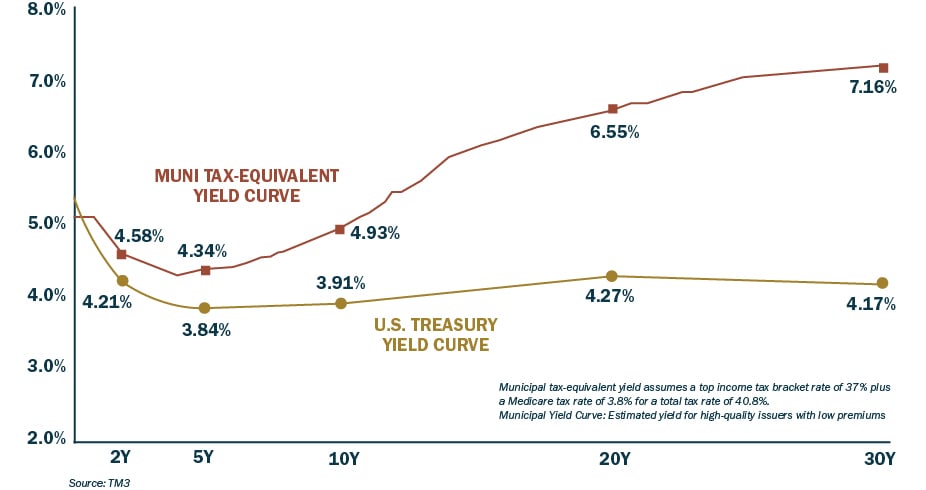

Among the compelling opportunities we find in fixed income today are tax-exempt municipal bonds, or munis. As income from state and local munis is generally exempt from federal taxes, we would encourage individual investors to review their investment objectives and consider an allocation to this asset class. For an investor in the highest marginal tax bracket, on a tax-equivalent basis, muni yields surpass Treasury bond yields across virtually the entire maturity spectrum. (Figure 1) The prospect of generating tax-equivalent returns approaching 5, 6, or even 7% for periods as long as 30 years — the highest yields in more than a decade — makes munis attractive not only as a source of reliable income but also as an appealing counterbalance to the volatility inherent in equity returns.

Figure 1 - Municipal Yields vs. Treasury Yields (Municipal Tax-equivalent and Treasury Yield Curves 1/31/24)

In addition, munis generally are viewed as high quality fixed income investments. This is due in part to their historically low default rates. Since 1970, for example, the cumulative 10-year average default rate for A-rated munis was 0.10%. For comparison, the default rate for A-rated corporate bonds over the same period was 1.90%. (Figure 2)

Figure 2 - Municipal Bonds vs. Corporate Bonds (10-year cumulative default rates 1970-2022)

Customized Investment Approach

At Commerce Trust, we believe no two clients are alike – and neither are their investment portfolios. Our investment team has the capabilities to build a separately managed, customizable portfolio for every client. Constructed from the broad investment universe, we create and manage tailored investment portfolios designed to efficiently capitalize on market opportunities we identify according to each client’s investment strategy, liquidity needs and sensitivity to risk.

Let us know how the Commerce Trust team of investment professionals can assist you with your investment goals and visit commercetrustcompany.com/investment-management to learn more about our investment management approach and read our latest insights on the market and investing.

|

Key Takeaways

|

The Chartered Financial Analyst® (CFA®) Charter is a designation granted by CFA Institute to individuals who have satisfied certain requirements, including completion of the CFA Program and required years of acceptable work experience. Registered marks are the property of CFA Institute.

Past performance is no guarantee of future results, and the opinions and other information in the commentary are as of February 28, 2024. This summary is intended to provide general information only and is reflective of the opinions of Commerce Trust. This material is not a recommendation of any particular security, is not based on any particular financial situation or need and is not intended to replace the advice of a qualified attorney, tax advisor or investment professional.

Commerce Trust is a division of Commerce Bank. Investment Products: Not FDIC Insured / May Lose Value / No Bank Guarantee

Interested in more insights?

Enter your email to join our subscribe.

Related Articles

Brent Schowe

Brent Schowe