Investment Management

A Legacy of Delivering Tailored Solutions

- Home

- Private Wealth Management

- Investment Management

Built on a Time-Tested Approach

With a focus on proprietary research, risk management and a time-tested investment process, we are well positioned to navigate through changing economic and market conditions to help our clients meet their investment objectives. We create and manage customized investment portfolios according to your guidelines and restrictions, liquidity needs and sensitivity to risk. Your portfolio can also be modified as your needs or objectives change. We are always mindful of portfolio expenses and focus on building efficient solutions that maximize your after-tax return.

Our Team

Our team of over 100 investment and research professionals with financial and professional certifications and credentials applies their knowledge in a structure that ensures the right balance of independent thinking and teamwork.

Our Process

Our process focuses on repeatable steps and aims to provide consistent returns while avoiding volatile or overly complex strategies.

Our Size

Our size enables us to offer clients unique benefits, including the flexibility to efficiently capitalize on relative value opportunities in the market and customize investment portfolios.

Our Investment Advisors

Our investment advisors have access to the quantitative and qualitative research of our internal research consultants as well as other providers.

The Commerce Trust team of over 100 practiced, credentialed investment professionals collaborate to act as your investment office.

Our Investment Philosophy

Our investment principles are guided by our fiduciary responsibility:

- Long-term asset allocation

- Diversification

- Both active and passive management

- Alternative investments*

- Rebalancing

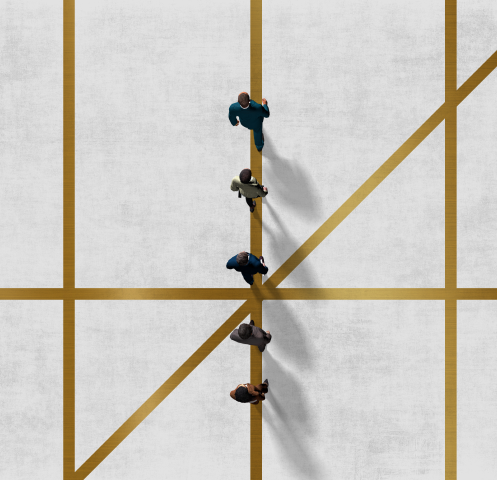

Four Steps to Success

Our investment management team utilizes a time-tested, four-step process for each client.

Envision Your Goals

Engage you in a thoughtful discussion about your situation, financial goals and priorities.

Identify Your Strategy

Work with you to identify an appropriate strategy and asset allocation that best reflects your income needs, tax situation, time horizon, risk tolerance and return expectations.

Construct Your Portfolio

Select stocks, bonds, investment managers and appropriate investment vehicles to build your custom portfolio.

Review Your Progress

Review your investment goals and adjust your portfolio as your needs change.

Investment Strategy Development

We provide you with a comprehensive program of analysis to help you understand your investment options.

- Asset allocation study to help you understand the risk and return tradeoffs of various allocation possibilities.

- Spending policy/sustainability study (including quantitative analysis of potential outcomes) to help you understand the sustainability of your portfolio given your expected spending.

- Benchmark analysis to assist you in choosing an appropriate measurement system for evaluating the investment program effectiveness.

- Tracking error analysis to help you understand the probabilities associated with outperformance of the chosen benchmark through time.

- Active versus passive analysis to help you understand the opportunities and risks associated with active management.

- Alternatives consulting to assist you with understanding the nontraditional investment opportunity set and your liquidity position.

* Incorporating alternative investment, such as derivatives, hedge funds, private equity, REITs, and commodities, into a portfolio presents the opportunity for significant losses including in some cases, losses which exceed the principal amount invested. Also, some alternative investments have experienced periods of extreme volatility and in general, are not suitable for all investors. Before you invest in alternative investments, you should consider your overall financial situation, how much money you have to invest, your need for liquidity, and your tolerance for risk.