4 min read

Technology's Influence on Equity Investing

Don McArthur, CFA® Senior Vice President, Senior Investment Strategist and Director of Equity Research

:

Mar 27, 2024 3:36:00 PM

Don McArthur, CFA® Senior Vice President, Senior Investment Strategist and Director of Equity Research

:

Mar 27, 2024 3:36:00 PM

|

Key Highlights

|

Many discussions on the performance of U.S. equity markets begins with a focus on the heavy influence of America’s fastest-growing companies. Today, that analysis starts with a group of seven mega-cap growth stocks: Alphabet (formerly Google), Amazon, Apple, Meta (formerly Facebook), Microsoft, Nvidia, and Tesla. Nicknamed the "Magnificent Seven," this group collectively comprised 28% of the S&P 500 market capitalization and returned 76% in 2023. By comparison, the remaining 493 companies in the index returned 14% for the year.

The Magnificent Seven have garnered considerable attention over recent quarters. However, investors’ long-held preference for similar growth-style stocks is undeniable. Technology-oriented stocks, or companies with a heavy reliance on technology to drive growth, represent a range of companies that span across multiple sectors within the stock market. Until a few years ago, most of these companies fell under the information technology sector in the S&P 500 before changes were made to even out the weightings in the index’s other sectors. For example, Apple is listed in the information technology sector, Meta in the communication services sector, and Amazon in the consumer discretionary sector. And while information technology is the largest sector within the S&P 500, the broader group of technology-oriented stocks now comprises nearly 50% of the index’s weighting.

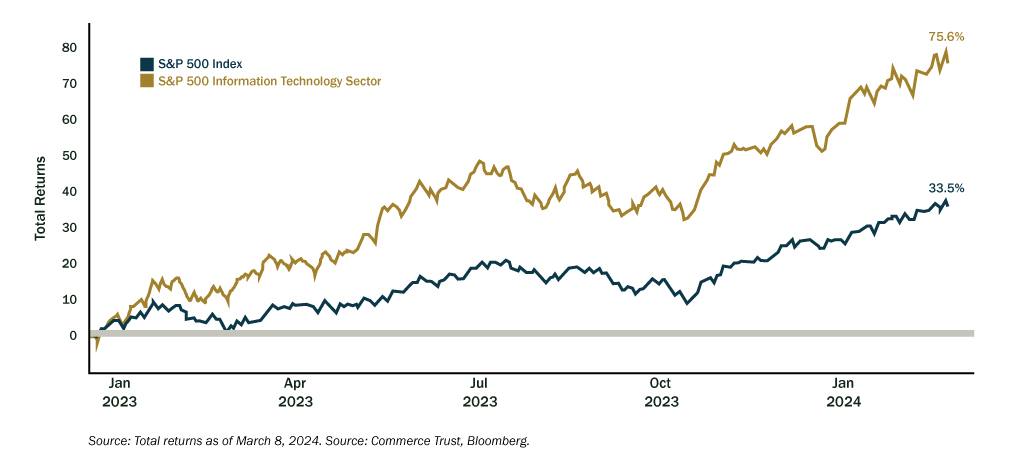

Technology Dominance of the S&P 500 Index, 2023-present

As the first quarter of 2024 winds down, some of 2023’s performance trends remain in place. Through February, the S&P 500 was up 7% for the year, again led by a narrow sample of stocks. Earnings growth also has been better than expected, with the information technology sector leading the way. For example, Nvidia beat earning expectations and delivered record full-year revenue growth for fiscal year 2024 when the company reported its financial results this February.1

Commerce Trust believes investor preference for these stocks will continue to be a key driver of equity returns throughout 2024, even as the narrow leadership within the S&P 500 evolves and includes companies from other sectors.

AI - The New Catalyst for Innovation

Part of the investor appeal for technology is the impact technology companies and their products can make on society and the everyday lives of people. These businesses leverage novel technologies to transform industry groups or create new business categories, growing market share by taking profits from competitors or other areas of the economy. Through continual innovation, these businesses tend to mature, exhibiting strong margins, pricing power, and diversified product portfolios.

Just as the internet, smartphone, and cloud computing innovated how information is gathered and used, Commerce Trust believes AI is poised to be the next revolutionary technological advancement.

It’s important to note that AI development and its potential impact on the economy and stock market is in the preliminary stages. Currently, most uses of AI center around improved productivity. Software developers use AI programs to assist with writing code.2 Biotechnology and pharmaceutical companies use AI tools to speed up the drug development process.3 However, the companies now profiting from AI innovation also provide the infrastructure of data networks to make it work.

Broader Returns Across Equities

In our Commerce Trust 2024 Economic Outlook, we shared our expectation that 2023’s narrow leadership theme could broaden across the equity spectrum. Equities are benefitting from a supportive U.S. economic backdrop and the easing of recessionary fears, which were consistent throughout 2023. In addition, the Federal Reserve has signaled that it may be done with the rate-hiking phase of its effort to tamp down inflation, with the markets pricing in multiple rate cuts for 2024.

Although the Magnificent Seven’s market capitalization remains high, we now see dispersion in performance among the group. Despite Nvidia’s strong earnings report, other companies have underperformed thus far for the year. This has opened opportunities across the S&P 500, with nine of the index’s 11 sectors delivering positive returns through February. Likewise, we see potential for broader equity opportunities within mid-cap and small-cap stocks.

Commerce Trust remains positive on technology-oriented stocks. Yet, the current dynamics within the S&P 500 across growth and value investment styles, as well as opportunities based on company size deserve consideration, underscoring our support for a diversified investment portfolio.

Navigating the complexities of rapidly evolving equity markets is a crucial part of a comprehensive wealth management plan. At Commerce Trust, a team of experienced investment management professionals monitors the dynamic market environment to best supplement your unique financial goals. Contact Commerce Trust today to learn more about how our team of investment professionals can assist you with your wealth management plan.

[1] Nvidia Announces Financial Results for Fiscal Year 2024, Nvidia, Feb. 21, 2024.

[2] American Association of the Advancement of Science, December 2022.

[3] “Using AI to Modernize Drug Development,” Forbes, Feb. 23, 2024.

The Chartered Financial Analyst® (CFA®) Charter is a designation granted by CFA Institute to individuals who have satisfied certain requirements, including completion of the CFA Program and required years of acceptable work experience. Registered marks are the property of CFA Institute.

Past performance is no guarantee of future results, and the opinions and other information in the commentary are as of March 11, 2024. This summary is intended to provide general information only and is reflective of the opinions of Commerce Trust. This material is not a recommendation of any particular security, is not based on any particular financial situation or need and is not intended to replace the advice of a qualified attorney, tax advisor or investment professional.

Diversification does not guarantee a profit or protect against all risk. Commerce Trust does not provide tax advice or legal advice to customers. Consult a tax specialist regarding tax implications related to any product and specific financial situation. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Commerce Trust is a division of Commerce Bank.

Investment Products: Not FDIC Insured | May Lose Value | No Bank Guarantee

Interested in more insights?

Enter your email to subscribe.

Related Articles