4 min read

Fixed Income Opportunities: Longer Duration in 2024

Brent Schowe

:

Apr 18, 2024 2:33:06 PM

Brent Schowe

:

Apr 18, 2024 2:33:06 PM

|

Key Highlights

|

Looking at the investment landscape in 2024, Commerce Trust believes the bond market is an area for investors to consider directing some attention, as the current interest rate environment presents opportunities not seen in over 15 years. Having experienced two periods of near-zero interest rates in the aftermaths of the 2007-08 global financial crisis and the COVID-19 pandemic, many investors have elected to invest funds in short-term instruments like Treasury bills, certificates of deposit, or CDs, and money market funds that currently offer yields of 5% or more. In fact, since the Federal Reserve (Fed) embarked on its aggressive rate-hiking campaign in March 2022, $1.5 trillion has poured into money market funds, with total assets in those investments at approximately $6 trillion.1

While income-oriented investors have benefitted from higher interest rates, it is important to understand that rates on money market funds closely follow economic cycles. At this point in the cycle, the Fed has signaled it is likely done with the rate-hiking phase of its efforts to tamp down inflation. Its next move will likely be to cut rates to guard against the possibility of the economy slowing too quickly under the weight of the hawkish monetary policy enacted over the past two years. And it’s not only savers who should take note of the potential for a reversal in interest rates. Equity-centric investors who have ridden stock markets to new highs may benefit from considering the attractive forward returns still available in the bond market.

Commerce Trust sees an allocation to longer duration bonds as a key component of fixed income portfolios in 2024. Duration measures a bond’s price sensitivity to interest rate fluctuations. The longer the duration of an asset or portfolio, the more sensitive it becomes to rate changes.

This approach may seem somewhat counterintuitive as we anticipate central banks to start cutting interest rates this year. However, an allocation to bonds when interest rates are already at or close to their peak could bode well for capital appreciation, especially since the market value of outstanding fixed-rate bonds can increase as interest rates fall.

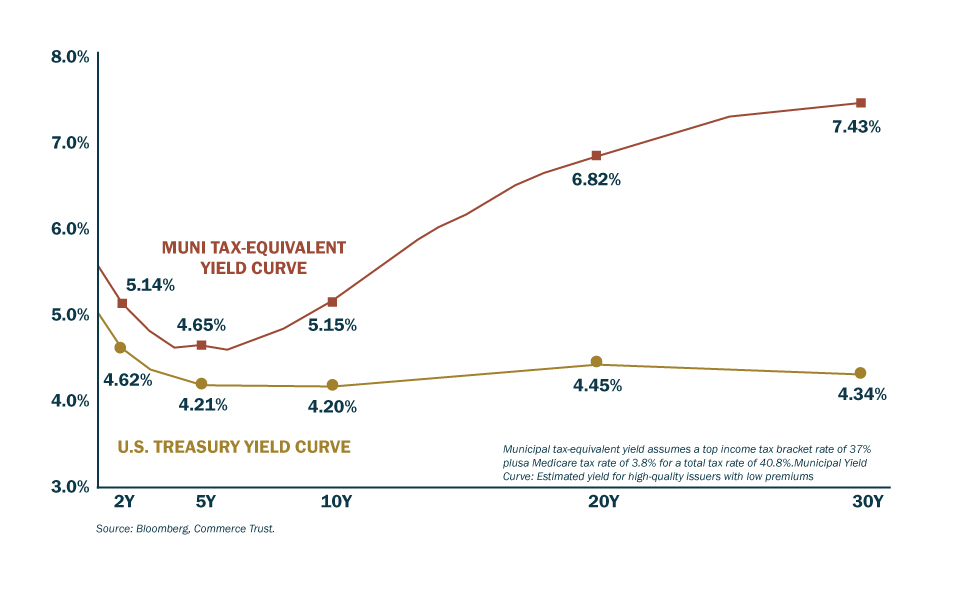

Among the compelling opportunities we find in fixed income today are tax-exempt municipal bonds, or munis. Since income from state and local munis is generally exempt from federal taxes, we encourage individual investors to review their investment objectives with their wealth management team and consider an allocation to this asset class. For an investor in the highest marginal tax bracket, on a tax-equivalent basis, muni yields surpass Treasury bond yields across virtually the entire maturity spectrum. (Figure 1) The prospect of generating tax-equivalent returns approaching 5, 6, or even 7% for periods as long as 30 years — the highest yields in more than a decade — makes munis attractive not only as a source of reliable income but also as an appealing counterbalance to the volatility inherent in equity returns.

Figure 1 - Municipal Tax-Equivalent and Treasury Yield Curve as of March 31, 2024

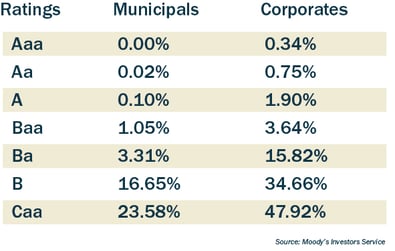

In addition, munis are generally viewed as high-quality fixed income investments. This is due in part to their historically low default rates. Since 1970, for example, the cumulative 10-year average default rate for A-rated munis was 0.10%. For comparison, the default rate for A-rated corporate bonds over the same period was 1.90%. (Figure 2)

Figure 2 - Municipal Bonds vs. Corporate Bonds (10-Year Cumulative Default Rates 1970-2022)

The Case for Emerging Market Bonds

Another area of opportunity within fixed income we see in 2024 is emerging market bonds, particularly dollar-denominated bonds. These are foreign bonds that are denominated in U.S. dollars rather than the issuing country’s currency. These instruments typically offer higher yields and longer duration than many developed international debt and U.S. debt counterparts. In fact, emerging market bonds returned over 9% in 2023, and currently offer yields greater than 7%, as measured by the Bloomberg Emerging Markets USD Aggregate Index.

Emerging market bonds tend to favor a more accommodating monetary policy environment, which we expect to see in 2024 as the Fed and other global central banks begin to cut interest rates. If the Fed begins to roll back interest rates this year as expected, it creates the potential for a weaker U.S. dollar, which could be supportive for emerging market bonds.

Moreover, declining global inflation may allow some emerging market central banks to move forward with their own interest rate cuts ahead of their peers in developed countries. This would not only lift the market value of outstanding emerging market securities but also stand to boost economic growth prospects in those countries. Given this environment, Commerce Trust believes an allocation to emerging market bonds may present opportunities for investors looking to diversify a fixed income portfolio.

Your investment portfolio, including any allocation to fixed income assets, should be based on your risk tolerance, time horizon, and broader investment goals. Before making any changes to your investment portfolio, contact the Commerce Trust team. Our wealth management team can review your investment portfolio to ensure your asset allocation matches your unique goals. Specialists across multiple disciplines including investment management and financial planning collaborate to implement a tailored strategy that aligns with your comprehensive wealth management plan.

[1] Money Market Fund Assets, Investment Company Institute; March 28, 2024.

The Chartered Financial Analyst® (CFA®) Charter is a designation granted by CFA Institute to individuals who have satisfied certain requirements, including completion of the CFA Program, and required years of acceptable work experience. Registered marks are the property of CFA Institute.

Past performance is no guarantee of future results, and the opinions and other information in the commentary are as of April 11, 2024. This summary is intended to provide general information only and is reflective of the opinions of Commerce Trust. This material is not a recommendation of any particular security, is not based on any particular financial situation or need and is not intended to replace the advice of a qualified attorney, tax advisor or investment professional.

Diversification does not guarantee a profit or protect against all risk. Commerce Trust does not provide tax advice or legal advice to customers. Consult a tax specialist regarding tax implications related to any product and specific financial situation. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Commerce Trust is a division of Commerce Bank.

Investment Products: Not FDIC Insured | May Lose Value | No Bank Guarantee

Interested in more insights?

Enter your email to subscribe.

Related Articles