3 min read

Selling a Business: How to Perform a Valuation

Diane Steinkamp Vice President, Privately Held Investment Manager

:

Aug 30, 2023 10:00:00 AM

Diane Steinkamp Vice President, Privately Held Investment Manager

:

Aug 30, 2023 10:00:00 AM

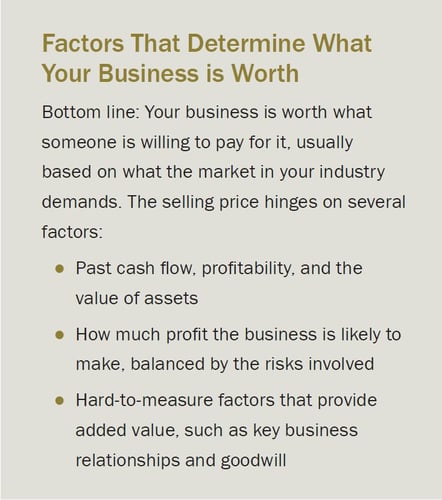

If you are preparing to sell your business, it is critical to know how much the company is truly worth. Accurately valuing your business ensures you will get the best sale price as a reward for your hard work, commitment, and determination.

Determining the value of a company is often easier said than done. A typical business valuation is based on both tangible and intangible factors. While tangible assets are significantly easier to measure, a substantial portion of business value is often intangible.

Decide on a valuation method

To get a general idea of how much your business is worth, there are some common methods for determining its value. The following discussion provides an overview of each method to help you decide which one makes the most sense for you and the future of your company.

Common methods for determining a business’s value include:

- Earning valuation

- Asset-based valuation

- Market value

You may find using only one method is not enough to come to a fair selling price for a starting figure for negotiations. If

that’s the case, consider using a combination of methods for your selling strategies.

Earning valuation method

The earning valuation method assumes the true value of your business is in its ability to create wealth in the future. There are two approaches you can use to value your business using this method.

- Capitalizing past earnings. With this approach, an appraiser uses your past earnings to determine an expected level of cash flow. Unusual revenue and expenses are normalized, then a capitalization factor is multiplied against the expected normal cash flows. The capitalization factor reflects the rate of return an average buyer would expect and measures the risk of not achieving expected earnings.

- Discounted future earnings. Discounted future earnings are based on predicted future earnings rather than past earnings. In this approach, the appraiser would predict future earnings to come up with an estimate — but not a promise — of future profitability.

Asset-based valuation method

An asset-based valuation takes into consideration all assets in your business and is typically more applicable to an asset-intensive business. A going concern asset-based valuation will list your company’s net balance sheet value of all assets and subtract the value of all liabilities. A liquidation asset-based valuation establishes the net cash that would be received if all your business assets were immediately sold on the open market and its liabilities paid.

Market value method

A market value method aims to establish a value based on what other similar businesses in your industry have sold for recently. This can be done by using multiples of EBITDA (earnings before interest, taxes, depreciation, and amortization), revenue, or net income.

Calculate your business goodwill

Goodwill is based on a combination of intangible factors that give your business greater value, such as:

- Relationships with customers and suppliers. A future owner has an advantage if a loyal client and supply base has already been built.

- Intellectual property (IP). This includes human creativity and innovation, such as a patent or a copyright.

- Location. One key to a successful business can be having a location close to customers, suppliers, or a transportation network.

- Liquidity. This refers to how quickly your business can get cash to meet its obligations.

- Brand equity. This factor pertains to how well consumers know your brand and how well your customers respect your business.

Establish the resale value of your assets

Calculate the resale value of your business’s fixed assets such as real estate, vehicles, office equipment, and machinery. For some of these assets, such as real estate, the value may increase over time. For others, such as work vehicles, the value will decrease as time passes.

To ensure the values of your fixed assets are accurate, use depreciation to project how their value will decrease over time.

Examine the market

Whether you use the market value method or not, you should look at the market when preparing to sell your business. This can help you get a sense of how companies in your industry are performing, as well as the value of similar businesses selling on the market.

How we can help

When selling your business, it is important to have an idea regarding the kind of buyer you would want to take over your company. Commerce Trust can help you determine what makes your business valuable to that type of buyer so you can try to maximize your company’s worth.

Contact us if you are wanting to understand your business value, assess how attractive your business is to potential buyers, have questions about how to proceed, or need further information and guidance from our advisors who have helped countless other business owners with this process.

The opinions and other information in the commentary are provided as of August 30, 2023. This summary is intended to provide general information only, and may be of value to the reader and audience.

This material is not a recommendation of any particular investment or insurance strategy, is not based on any particular financial situation or need, and is not intended to replace the advice of a qualified tax advisor or investment professional. While Commerce may provide information or express opinions from time to time, such information or opinions are subject to change, are not offered as professional tax, insurance or legal advice, and may not be relied on as such.

Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

INVESTMENT PRODUCTS: NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE