5 min read

Consider Life Insurance That Pays for Long-Term Care

Chris Ward Senior Vice President, Financial Advisor Commerce Brokerage Services, Inc.

:

Jul 12, 2023 2:01:00 PM

Chris Ward Senior Vice President, Financial Advisor Commerce Brokerage Services, Inc.

:

Jul 12, 2023 2:01:00 PM

Life insurance has many uses, including income replacement, business continuation, and estate preservation. Here’s one more: Regardless of where you are in the retirement planning process, you should be considering how life insurance can provide financial protection against the potentially high cost of health care down the road. Why? Because no matter where you live, no matter how old you are, no matter how healthy you are today — no one is exempt from the possibility of needing long-term care at some point in the future.

People Are Living Longer: The Majority Will Require Long-Term Care

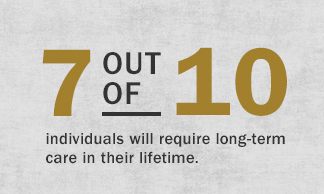

According to a recent Genworth Cost of Care survey, supply and demand is the primary driver of long-term care services. The world’s population is aging at a faster rate than ever before, and people are living longer. Every day until 2030, ten thousand (10,000) Baby Boomers will turn 65, and 7 out of 10 individuals will require long-term care in their lifetime.1

According to a recent Genworth Cost of Care survey, supply and demand is the primary driver of long-term care services. The world’s population is aging at a faster rate than ever before, and people are living longer. Every day until 2030, ten thousand (10,000) Baby Boomers will turn 65, and 7 out of 10 individuals will require long-term care in their lifetime.1

Yet, as sobering as these numbers are, long-term care coverage seems to be one of those “maybe someday” purchases usually delegated to the bottom of the list behind the more immediate demands on people’s finances. Not to mention long-term care insurance policy premiums can be expensive — and, yes, there is a chance you will never have to use it. If that’s the case, you may be asking yourself, “Do I really need long-term care coverage?” The answer is “yes” — and fortunately there is a way to have a life insurance policy that combines a death benefit with a long-term care benefit that may appeal to you.

Paying for Long-Term Care Expenses

The responsibility for paying for long-term care services and facilities rests on your shoulders. And depending on the amount and type of care you need — and the company that is the provider — long-term care can be expensive. For example, in 2021, the annual cost of assisted living facilities rose an average of 4.65% over the previous year, with the cost for a private, one bedroom reported to be $54,000. The national average cost of nursing home care for the same time frame was $94,900 a year for a semi-private room and $108,405 a year for a private room. These costs do not include items such as therapies and medications, which could make the numbers much higher.1

Many people assume Medicare, Medicare supplemental insurance, and regular health insurance (medical insurance) typically will pay for long-term care assistance or facilities. They do not. However, there is some assistance from Medicaid for those who qualify. For people who don’t have a long-term care insurance policy or a long-term care insurance alternative, typically expenses are paid out-of-pocket with funds from savings accounts, retirement plans, or investments. Unfortunately, some individuals who have incurred extremely high expenses end up selling their homes to pay for long-term care needs. Fortunately, there are other options — such as a combination life insurance policy — you may want to consider.

Every day until 2023, ten thousand (10,000) Baby Boomers will turn 65, and 7 out of 10 individuals will require long-term care in their lifetime.1

Combination Life Insurance Has Dual Appeal

Many life insurance companies offer combination life insurance policies that include a long-term care rider available for an additional charge. If you buy this type of policy, you can pay the premium in a single lump sum or make periodic payments. The death benefit amount and long-term care allowance are based on your age, gender, and health at the time you buy the policy. The appeal of this combination policy lies in the fact that either you’ll use the policy to pay for long-term care expenses or your beneficiaries will receive the insurance proceeds at your death.

Long-Term Care Riders Provide a Variety of Benefits

With a combination policy, the long-term care benefit is added to the life insurance policy with either an accelerated benefits rider or an extension of benefits rider.

With an accelerated benefits rider:

- You can access your death benefit while you are alive to pay for expenses related to long-term care.

- The death benefit is reduced by the amount you use for long-term care expenses.

- The death benefit will eventually be depleted if you need long-term care for a lengthy period of time.

- You must have medically certified impairment for 90 days before the insurer will pay for any long-term health care costs.

This same rider also can be used if you have a terminal illness that may require payment of large medical bills. Because accelerating the death benefit can have unfavorable tax consequences, you may want to consult your tax professional before exercising this option.

With an extension of benefits rider:

This type of rider increases your long-term care coverage beyond your death benefit. An extension of benefits rider differs from company to company as to its specific application. Depending on the issuer, the extension of benefits rider either increases the total amount available for long-term care (the death benefit remains the same) or extends the number of months over which long-term care benefits can be paid. In either case, long-term care payments will reduce the available death benefit of the policy. However, some companies still pay a minimum death benefit even if the total of all long-term care payments exceeds the policy’s death benefit amount.

Qualifying for Payments Under Long-Term Care Riders

Typically, qualifying for payments under a long-term care rider is similar to the requirements for most stand-alone long-term care policies.

- You must be unable to perform some of the activities of daily living (bathing, dressing, eating, getting in or out of a bed or chair, toilet use, or maintaining continence) or suffer from a severe cognitive impairment.

- An elimination period may also apply: You pay for the initial cost of long-term care out-of-pocket for a specific number of days (usually 30 to 90) before you can apply for payments under the policy.

As with all life and long-term care insurance, the insurance company will require you to answer some health-related questions and undergo a physical examination before issuing a combination policy to you.

We Can Help

Deciding whether a combination policy is right for your unique circumstances depends on a number of factors. It’s an important decision that should be weighed carefully in the context of your total financial life. Our team of professionals can help you determine if this is your best long-term care coverage option and work with you to put the proper plan in place. Contact us today — we will listen to your concerns, answer all your questions, and discuss how these and other considerations fit into your financial goals.

¹Source: Genworth Cost of Care Survey, “Executive Summary and Methodology of 2021 Survey Findings,” https://www.genworth.com/aging-and-you/finances/cost-of-care.html, November 10, 2022.

The opinions and other information in the commentary are provided as of July 12, 2023. This summary is intended to provide general information only, and may be of value to the reader and audience. This material is not a recommendation of any particular investment or insurance strategy, is not based on any particular financial situation or need, and is not intended to replace the advice of a qualified tax advisor or investment professional. While Commerce may provide information or express opinions from time to time, such information or opinions are subject to change, are not offered as professional tax, insurance or legal advice, and may not be relied on as such. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Sections of this article were prepared by Broadridge Investor Communication Solutions, Inc. Copyright 2016. Broadridge Investor Communication Solutions, Inc. does not provide investment, tax, or legal advice. The information presented here is not specific to any individual’s personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable – we cannot assure the accuracy or completeness of these materials.

The information in these materials may change at any time and without notice. There may be surrender charges at the time of surrender or withdrawal and are taxable if you withdraw more than your basis in the policy. Any guarantees are contingent on the claims-paying ability and financial strength of the issuing company. The cost and availability of life insurance depend on factors such an age, health, and the type and amount of insurance purchased. Life insurance policies have exclusions, limitations, and terms for keeping them in force.

Commerce Trust is a division of Commerce Bank. Investment Products: Not FDIC Insured / May Lose Value / No Bank Guarantee