Retirement Planning

For High-Net-Worth Individuals

- Home

- Private Wealth Management

- Retirement Planning

Envisioning Your Retirement

At what age do you wish to retire and how do you or you and your spouse envision spending your retirement? Whether you are saving diligently for retirement or unexpected life events have introduced new considerations, the complexities of planning for retirement can be challenging.

Through personalized financial planning, a Commerce Trust advisor can help you identify opportunities and explore the potential impact of different life events on your retirement plan. Our aim is to provide you with the confidence you will be able to enjoy the lifestyle you envision in retirement.

Our approach starts by fully understanding your personal and financial goals relating to retirement. From there, we incorporate a variety of different tools, such as a sustainability analysis that assesses cash flow and assets over time and a suite of sophisticated analytical tools that provide the probability of your plan meeting objectives.

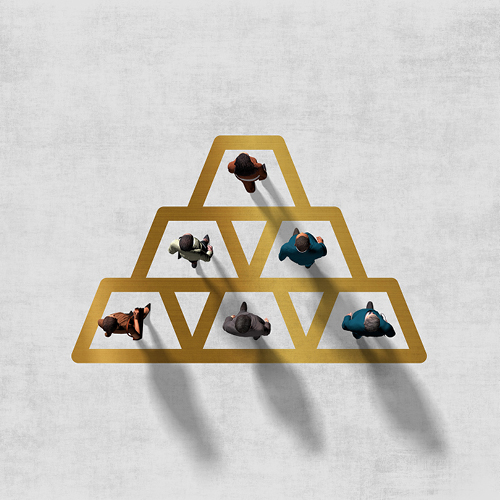

A Commerce Trust Advisor Can Assist You and Your Family with:

- Knowing when to begin taking withdrawals from your retirement accounts

- Understanding important Medicare information

- Understanding the impact of earned income on Social Security benefits

- Deciding which type of IRA savings option is right for you

- Ensuring income sufficiency, developing a strategy together to meet your needs

- Understanding the benefit of catch-up contributions

*Commerce Trust does not provide advice relating to rolling over retirement accounts.