3 min read

The Juggling Act of Saving for Retirement and College

Robert E. Whitney, Jr., CFP®,

:

Sep 22, 2022 11:00:00 AM

Robert E. Whitney, Jr., CFP®,

:

Sep 22, 2022 11:00:00 AM

Saving for college shouldn’t cause you to stress out about your retirement. But if you’re in the same boat as many other families, saving for retirement and college at the same time can be a financial juggling act. Both life experiences come with hefty price tags — factor in inflation and the sticker shock on each just keeps going higher.

Having a plan is key

You’ve heard it said many times – having a plan is key to achieving your financial goals. In addition to having a sound financial plan, you should pay close attention to a variety of risk factors you may encounter on the road to achieving your dreams. When you consider using your hard-earned money to help anyone — including your children — it’s important to know where you stand with your own personal finances, budget, and investments. Periods of market volatility and economic uncertainty are great opportunities to revisit your financial situation.

Think about how much money you’ll need

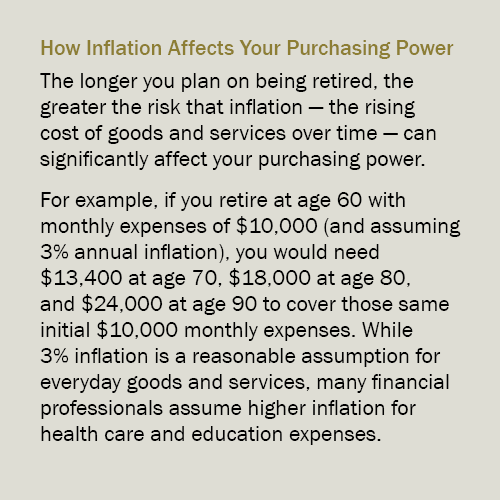

You probably have some ideas about when you want to stop working as well as the type of lifestyle you want to enjoy in your retirement years. Your investment timeline likely extends well into the future. As you think about how much money you’ll need to live comfortably in retirement, be sure to consider the impact of rising health care costs, a higher cost of living due to inflation, and the potential of outliving your assets. That’s why it’s important to start saving for your goals as early as possible.

If you have children and are also trying to plan for their higher education expenses, you need to account for inflation when projecting the annual cost of sending your student(s) off to college. Tuition often outpaces general inflation, increasing about 8% per year according to Finaid. That means on average, the cost of college doubles every nine years.

The numbers are staggering — and depending on a family’s financial situation and where their student wants to go to college, hard choices often have to be made. For many parents who would do anything to make sure their children succeed, retirement often ends up taking a back seat to their children’s higher education.

But it doesn’t have to be that way—you don’t have to choose one goal over the other.

What are the choices when saving for two goals at the same time?

With a little planning, budgeting, and discipline, you can save enough money to turn both dreams into reality. Here’s how.

First, pay yourself. Every paycheck, contribute 10% to 15% of your income to your 401(k), 403(b), or other employer sponsored savings plan. At the very minimum, fund your retirement account to get the full employer match if offered.

Pad your savings when you get a raise, bonus, or cash windfall (such as an inheritance or winning a lottery). For example, if you receive a 3% raise or bonus, consider putting 1% in your retirement account, 1% toward a college savings account, and direct the remaining 1% towards an after-tax investment account or savings account if you don’t already have an emergency fund to cover three to six months of expenses.

Invest in a 529 Savings Plan. Talk with an advisor about opening a 529 Savings Plan with your child as the beneficiary. These investment accounts provide tax-free growth. If your child is a newborn or very young, he or she won’t be needing college funds for some time — and if you make deposits on a regular basis you can take advantage of years of compounding growth. The account’s earnings are also potentially tax-free as long as you use the withdrawals to pay for the beneficiary’s qualified higher education expenses.

Open two Roth IRAs. One is for your retirement fund and the other is for your child’s college expenses. There’s currently an annual combined contribution limit of $6,000 ($7,000 if you’re 50 or older). You can take an early withdrawal without penalty for qualified expenses such as tuition. Again, talk with an advisor to determine if this is a good savings and investment alternative for you.

Suggest family and friends give monetary gifts rather than toys, games, and electronics. If your child gets more than enough gifts on holidays and special occasions, ask relatives and friends to give money to put toward your child’s college education instead.

Next steps

A Commerce Trust advisor can address your concerns and help you answer important questions regarding how to handle the ongoing effects of inflation and other risk factors affecting your savings and investment plans. We will listen and offer solutions tailored to help you achieve your retirement and education goals. Contact us today for more information.

The opinions and other information in the commentary are provided as of September 22, 2022. This summary is intended to provide general information only, and may be of value to the reader and audience.

This material is not a recommendation of any particular investment strategy, is not based on any particular financial situation or need, and is not intended to replace the advice of a qualified tax advisor or investment professional. While Commerce may provide information or express opinions from time to time, such information or opinions are subject to change, are not offered as professional tax, insurance, or legal advice, and may not be relied on as such.

Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Commerce Trust is a division of Commerce Bank.

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE

You’ve heard it said many times – having a plan is key to achieving your financial goals. In addition to having a sound financial plan, you should pay close attention to a variety of risk factors you may encounter on the road to achieving your dreams. When you consider using your hard-earned money to help anyone — including your children — it’s important to know where you stand with your own personal finances, budget, and investments. Periods of market volatility and economic uncertainty are great opportunities to revisit your financial situation.

Think about how much money you’ll need

You probably have some ideas about when you want to stop working as well as the type of lifestyle you want to enjoy in your retirement years. Your investment timeline likely extends well into the future. As you think about how much money you’ll need to live comfortably in retirement, be sure to consider the impact of rising health care costs, a higher cost of living due to inflation, and the potential of outliving your assets. That’s why it’s important to start saving for your goals as early as possible.

If you have children and are also trying to plan for their higher education expenses, you need to account for inflation when projecting the annual cost of sending your student(s) off to college. Tuition often outpaces general inflation, increasing about 8% per year according to Finaid. That means on average, the cost of college doubles every nine years.

The numbers are staggering — and depending on a family’s financial situation and where their student wants to go to college, hard choices often have to be made. For many parents who would do anything to make sure their children succeed, retirement often ends up taking a back seat to their children’s higher education.

But it doesn’t have to be that way—you don’t have to choose one goal over the other.

What are the choices when saving for two goals at the same time?

With a little planning, budgeting, and discipline, you can save enough money to turn both dreams into reality. Here’s how.

First, pay yourself. Every paycheck, contribute 10% to 15% of your income to your 401(k), 403(b), or other employer sponsored savings plan. At the very minimum, fund your retirement account to get the full employer match if offered.

Pad your savings when you get a raise, bonus, or cash windfall (such as an inheritance or winning a lottery). For example, if you receive a 3% raise or bonus, consider putting 1% in your retirement account, 1% toward a college savings account, and direct the remaining 1% towards an after-tax investment account or savings account if you don’t already have an emergency fund to cover three to six months of expenses.

Invest in a 529 Savings Plan. Talk with an advisor about opening a 529 Savings Plan with your child as the beneficiary. These investment accounts provide tax-free growth. If your child is a newborn or very young, he or she won’t be needing college funds for some time — and if you make deposits on a regular basis you can take advantage of years of compounding growth. The account’s earnings are also potentially tax-free as long as you use the withdrawals to pay for the beneficiary’s qualified higher education expenses.

Open two Roth IRAs. One is for your retirement fund and the other is for your child’s college expenses. There’s currently an annual combined contribution limit of $6,000 ($7,000 if you’re 50 or older). You can take an early withdrawal without penalty for qualified expenses such as tuition. Again, talk with an advisor to determine if this is a good savings and investment alternative for you.

Suggest family and friends give monetary gifts rather than toys, games, and electronics. If your child gets more than enough gifts on holidays and special occasions, ask relatives and friends to give money to put toward your child’s college education instead.

Next steps

A Commerce Trust advisor can address your concerns and help you answer important questions regarding how to handle the ongoing effects of inflation and other risk factors affecting your savings and investment plans. We will listen and offer solutions tailored to help you achieve your retirement and education goals. Contact us today for more information.

The opinions and other information in the commentary are provided as of September 22, 2022. This summary is intended to provide general information only, and may be of value to the reader and audience.

This material is not a recommendation of any particular investment strategy, is not based on any particular financial situation or need, and is not intended to replace the advice of a qualified tax advisor or investment professional. While Commerce may provide information or express opinions from time to time, such information or opinions are subject to change, are not offered as professional tax, insurance, or legal advice, and may not be relied on as such.

Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Commerce Trust is a division of Commerce Bank.

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE