3 min read

Staying Confident During Turbulent Markets

David Wynn, CFA®, Portfolio Manager

:

Feb 3, 2023 7:00:00 AM

David Wynn, CFA®, Portfolio Manager

:

Feb 3, 2023 7:00:00 AM

Financial markets often experience highly volatile conditions during periods of economic transition like we’re currently experiencing.

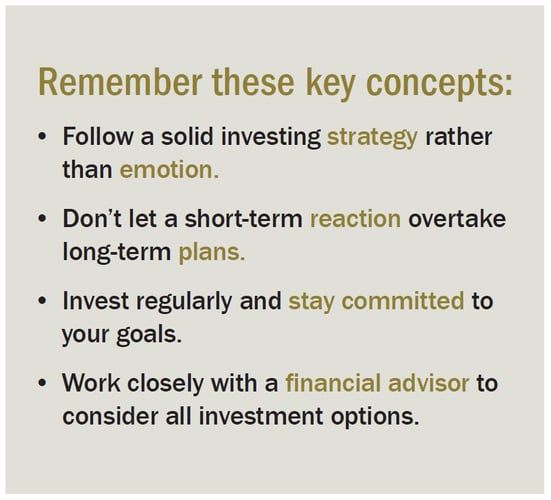

When market conditions appear to become unfavorable or economic news becomes unsettling, the uncertainty can prompt some investors to head for the exits and ask questions later. At Commerce Trust, we believe staying focused on long-term financial or retirement goals requires the ability to navigate through all market cycles.

History can provide some perspective. Here are five themes to demonstrate how the stock market – as represented by the S&P 500 Index – has continued a long-term upward trend, even following the most turbulent market settings.

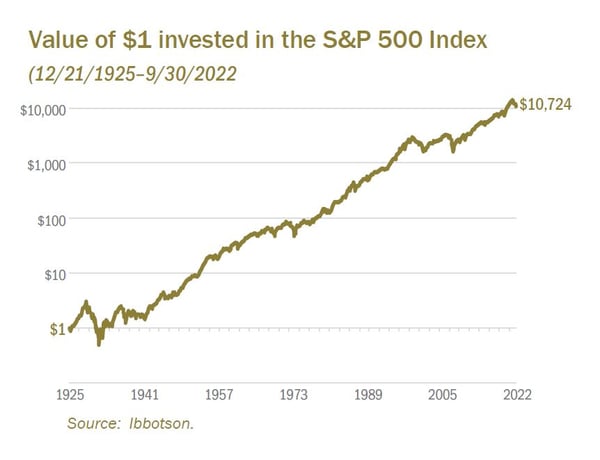

Through bull and bear markets, through recessions and wars, investing opportunities tend to reward patient investors. Since 1925, the S&P 500 has produced a 10.1% compound annual return. So, a hypothetical $1 investment in stocks made in 1925 would have a value exceeding $11,000 today despite all the declines the market has experienced in nearly 100 years (see chart.)

Think about what occurred over the past 100 years: The Market Crash of 1929 and Great Depression, World War II, the 1973 oil crisis, Black Monday in 1987, the dot com bubble in the early 2000s, the subprime mortgage crisis of 2007 and most recently, the COVID-19 pandemic. Certainly, investors experienced unsettled feelings during these periods as we might today. This is a great example of how time can work for individuals who stay invested in the market.

TIME IN THE MARKET

Some people believe investing is a matter of timing. As the saying goes, “Buy low, sell high.” But there’s a problem with this mindset: Even the smartest investment professionals can’t accurately predict the exact timing of market moves.

We believe long-term investment success is more likely the result of a consistent approach, based on time in the market — not market timing. For example, selling when markets decline can put you on the sidelines when stocks change direction. Turnarounds often happen quickly and typically are strong during the early stages.

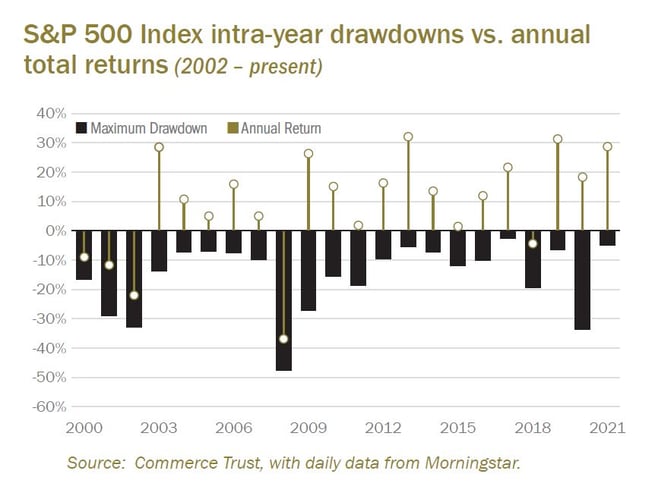

Let’s look at the S&P 500 over the past 20 years. In virtually all years, market volatility resulted in intra-year drawdowns, with some being painful. It’s common for the market to recover some of those losses during the year, with annual returns that typically are more positive than the worst declines. It’s worth noting the three years with the most dramatic drawdowns typically delivered higher annual returns.

BULLS FOLLOW BEARS

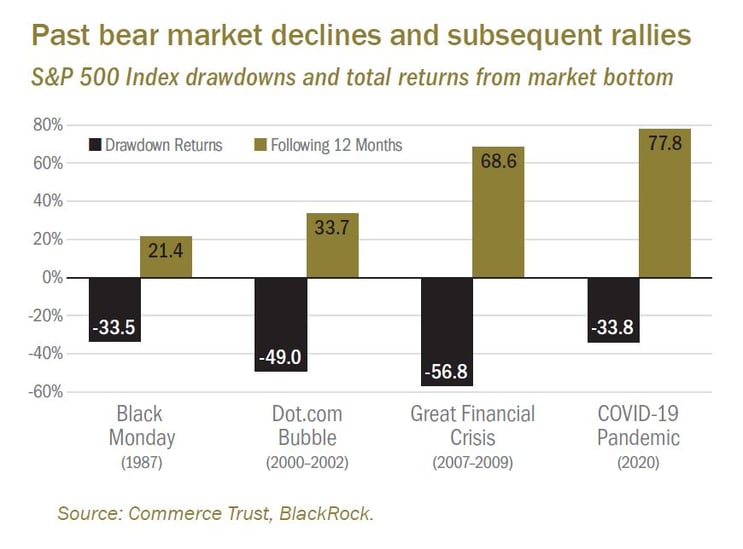

A bear market is defined as a decline of 20% or more of a major stock market index for a sustained period amid widespread pessimism and negative investor sentiment. Bear markets like we’re currently experiencing can test even the most steadfast long-term investors. However, these conditions don’t last forever. In fact, the most memorable short-term declines over the past 35 years all produced double-digit returns within 12 months from the market bottom.

Despite the economic challenges of those difficult years, a patient and committed investor could have had a positive return on money invested in the stock market.

STOCKS PERFORMANCE AROUND RECESSIONS

Looking at our current economic environment, there’s little doubt the U.S. economy is cooling. The pace of growth as measured by gross domestic product (GDP) was negative for the first two quarters of 2022. While the economy rebounded in the second half of the year, we believe the odds have significantly increased the U.S. economy slips into a recession at some point in 2023, most likely the latter half of the year.

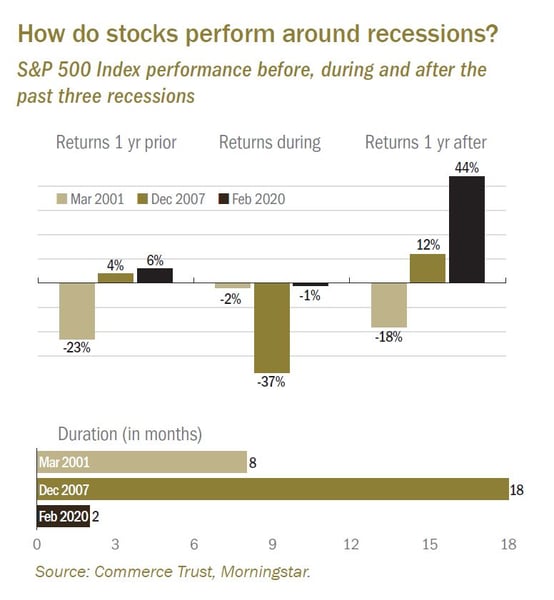

What does this mean for investors? Using recent history as a guide, stock performance often begins to decline before the official start of a recession and frequently begins to rebound before it ends. More importantly, the S&P 500 tends to bounce back sharply within the following year of a recession, with the 2001 dot com bubble contraction being the exception. Remember: being out of the market when turnarounds happen can be costly.

PERSPECTIVE AND RESILIENCE

Working with a financial professional, there are actions investors can take during turbulent markets. A diversified portfolio may help smooth returns when certain areas of the market are underperforming. Periodically rebalancing a portfolio during extended periods of market stress may present buying opportunities. In addition, taking the steps to de-risk a portfolio during downturns may reduce exposure to more volatile asset classes. A diversified portfolio invested in quality investments will allow the opportunity to not miss out when the market recovery begins.

Another important consideration is to remember an investment timeline probably extends longer than next week or next year. The time horizon to retirement could be even five, 10 or even 20 years for some investors. At Commerce Trust, we help clients focus on investments through retirement. If you have questions about your portfolio, contact a Commerce Trust financial advisor to be sure your investments are properly aligned with your goals.

The Chartered Financial Analyst® (CFA®) Charter is a designation granted by CFA Institute to individuals who have satisfied certain requirements, including completion of the CFA Program and required years of acceptable work experience. Registered marks are the property of CFA Institute.

Past performance is no guarantee of future results, and the opinions and other information in the commentary are as of 2/1/2023. This summary is intended to provide general information only and is reflective of the opinions of Commerce Trust. This material is not a recommendation of any particular security, is not based on any particular financial situation or need and is not intended to replace the advice of a qualified attorney, tax advisor or investment professional.

Diversification does not guarantee a profit or protect against all risk. Commerce Trust does not provide tax advice or legal advice to customers. Consult a tax specialist regarding tax implications related to any product and specific financial situation. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Commerce Trust is a division of Commerce Bank.

Investment Products: Not FDIC Insured | May Lose Value | No Bank Guarantee