Trust and Estate Planning

Personal Trust Services for Protecting Your Wealth

- Home

- Private Wealth Management

- Trust and Estate Planning

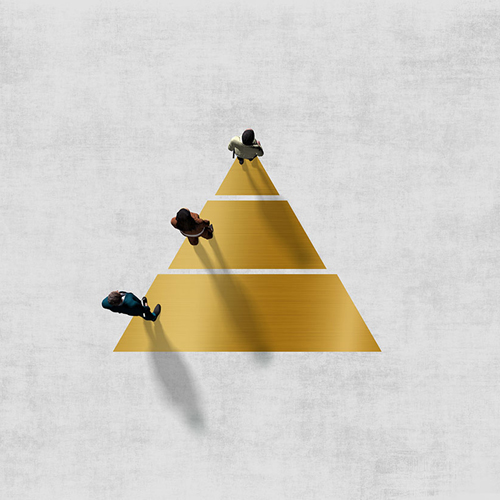

Protecting Your Wealth

Preserving your assets and investments can be as challenging as building them. An experienced trust and estate planning advisor can help you protect your wealth and navigate the process of setting up a trust.

Our team works with you to recognize potential risks to you and your family, identify ways to minimize your exposure, and keep you in control of your financial future.

Utilizing personal trust and estate planning services can help you maintain control of your finances by:

- Coordinating wealth transfer, estate tax planning, and tax-efficient strategies to help you reduce taxes

- Providing for family, friends and/or charitable causes

- Distributing your assets privately and expeditiously by avoiding probate

- Outlining your medical wishes including a health care directive and durable power of attorney

Benefits of a Commerce Trust private client advisor:

- Maintain your lifestyle without the administrative burden of managing the details

- Stay informed about your financial position

- Ensure an organized structure to help your family understand your financial condition and make good decisions

A Commerce Trust Advisor can assist you and your family with:

Trust and Probate Administration

Charitable Trusts

Family Foundation Management

Real Estate Management

Closely Held Business Management

Tax Compliance and Reporting

Personal Bill Paying

Eldercare Services

Consult an attorney for legal advice, including drafting and execution of estate planning documents.