4 min read

How Secure Act 2.0 Can Help You Save More for Retirement

Robert E. Whitney, Jr., CFP®,

:

Mar 8, 2023 7:00:00 AM

Robert E. Whitney, Jr., CFP®,

:

Mar 8, 2023 7:00:00 AM

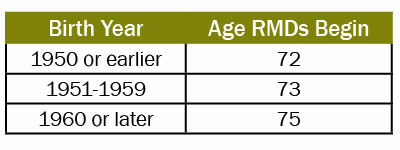

1. Required minimum distribution (RMD) ages pushed back again

For those of you close to retirement or already retired, you may recall that the SECURE Act legislation passed in 2019 pushed back the RMD age from 70-1/2 to 72 years. Under the SECURE 2.0, RMDs now will begin at age 73 for individuals born between 1951 and 1959, and age 75 for persons born in 1960 or later.

Interestingly, no one will have their RMD begin in 2023. For example, if you were born in 1950, your RMD began in 2022. But what if you were born in 1951 and turn 72 in 2023? Under the new law, your RMD will be pushed back a year to 2024 and will start at age 73 instead. Age 73 will remain the required age when RMDs begin through the year 2032. The following year (2033), RMDs will be required at age 75.

Under the new legislation, the penalty for the portion of a RMD that is not satisfied on or before the required date has been reduced from 50% to 25% — and further reduced to a 10% penalty if the shortfall is rectified within a “correction window.” The “correction window” is defined as beginning on the date that tax penalty is imposed and ends upon the earliest of the following dates:

-

When the Notice of Deficiency is mailed to the taxpayer;

-

When the tax is assessed by the IRS; or

-

The last day of the second tax year after the tax is imposed.

2. New RMD option for surviving spouse of a retirement account owner

Beginning in 2024, a surviving spouse of a retirement account owner can elect to use the age of the deceased spouse for RMD purposes if it’s advantageous. Under these circumstances, RMDs for the surviving spouse would be delayed until the deceased spouse would have reached the required birth year to commence RMD distributions.

For example, let’s say Mr. Smith is 65 years old, and Mrs. Smith is 70 years old. Mr. Smith dies first. His wife can elect to use her husband’s age to delay beginning her RMDs until such time when Mr. Smith would have reached his required age for distributions. If Mrs. Smith would die before the RMDs began, her beneficiaries will be treated as the original beneficiaries.

3. Changes related to the Roth Individual Retirement Account (IRA)

The following bullets highlight various ways the new law affects Roth IRAs:

-

Eliminates RMDs for Roth accounts in qualified employer plans (e.g., Roth 401(k) and Roth 403(b) plans); begins in 2024.

-

Allows creation of Savings Incentive Match Plan for Employees (SIMPLE) and Simplified Employee Pension (SEP) Roth IRAs beginning in 2023; this will take some time for custodians to implement.

-

Permits employers to deposit matching and/or nonelective contributions to employees’ designated Roth accounts.

o Previously, if an employee elected Roth contributions in their company plan, employer contributions went into their pre-tax portion.

o Such employer amounts, if elected by the individual to go into the Roth portion, will be included in the employee’s income in the year of contribution, and must be nonforfeitable (not subject to vesting).

-

Beginning in 2024, high-wage earners (over $145,000) who elect to make catch-up contributions must put them into their employers’ Roth portion, not the pre-tax portion.

-

Also beginning next year, the changes in the law allow 529 plan rollovers to Roth IRAs after 15 years.

o The maximum lifetime rollover amount is $35,000.

o The Roth IRA must be in the name of the 529 plan beneficiary.

o The 529 plan must have been maintained for at least 15 years.

o Contributions/earnings within the last 5 years are not eligible.

o Total annual contributions to the Roth IRA (including any 529 plan rollover) cannot exceed annual limit ($6,500 in 2023).

It’s important to note the changes the SECURE 2.0 made to the RMD age guidelines do not have any impact on when Qualified Charitable Distributions (QCDs) can be made. QCDs can still begin at age 70 1/2.

Beginning in 2023, the new bill gives individuals a one-time opportunity to distribute up to $50,000 of a QCD to certain split-interest giving trusts: a Charitable Remainder Unitrust (CRUT), Charitable Remainder Annuity Trust (CRAT), or a Charitable Gift Annuity (CGA). No additional funds can be added.

Additionally, SECURE 2.0 indexes the $100,000 qualified distribution limit to increase with inflation in 2024. This can be a useful planning technique. Why? Because income is excluded from taxable income and, therefore, not included when calculating SSI/Medicare surcharges.

What was not addressed in the new legislation

While the SECURE 2.0 contains many positive changes to help taxpayers save more for their retirement, there are provisions many thought would be addressed that were not. One being back door Roth conversions, a strategy used to move money from a traditional IRA to a Roth IRA, regardless of income limits.

Next steps

Whenever there are major legislative changes that affect you and your money, it’s always a good idea to consult with financial, legal, and tax professionals to learn how the new laws impact your personal financial situation.

We’re here to help you understand what the SECURE 2.0 means for you and your family, now and in the future. Discover firsthand how our team of professionals can offer guidance with your financial planning, explain potential opportunities for growing your wealth, and help implement a wide range of solutions to get you to and through retirement. We encourage you to contact Commerce Trust today.

Source: SECURE 2.0 Act of 2022, signed into law on December 29, 2022.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the certification marks CFP® and CERTIFIED FINANCIAL PLANNER™ in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

The opinions and other information in the commentary are provided as of February 16, 2023. This summary is intended to provide general information only, and may be of value to the reader and audience.

This material is not a recommendation of any particular investment or insurance strategy, is not based on any particular financial situation or need, and is not intended to replace the advice of a qualified tax advisor or investment professional. While Commerce may provide information or express opinions from time to time, such information or opinions are subject to change, are not offered as professional tax, insurance or legal advice, and may not be relied on as such.

Commerce does not provide tax advice to customers unless engaged to do so.

Commerce Trust does not provide advice related to rolling over retirement accounts.

Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.